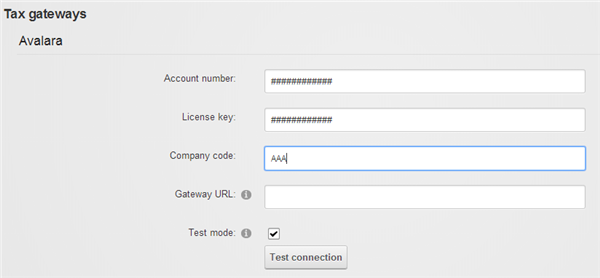

Avalara AvaTax provides real-time tax rates for U.S and international addresses. The following fields are required:

- Account number

- License key

- Company code

To ensure complete accuracy in tax calculation, we recommend that all your configured tax methods are set to use AvaTax exclusively and you're not mixing between custom rules and other tax providers.

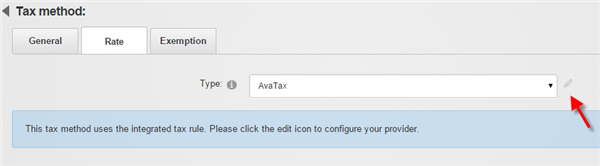

Under Configuration > Taxes menu, click Add new to create a new tax method and select "AvaTax" as your tax type. Give it a name (e.g. "Products"). If you need to define a special tax category (e.g. you need to tax differently for shipping), you can enter a Avalara tax code otherwise leave the tax code empty and click Save.

Ensure you have created your organization and selected your Nexus jurisdiction in your Avalara administration settings first. Click on the edit icon to enter your Avalara credentials.

Click on Test connection to make sure your credentials work. Then Save.

Please note you can define as many different tax methods as needed. Any of your product variants, handling or shipping can now associate to these tax methods and will be treated as taxable.

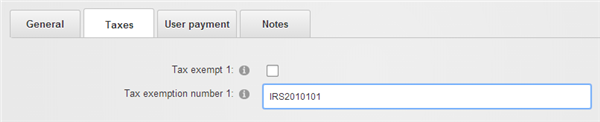

Tax exemption

A customer may be exempt from taxes if they have a valid tax exemption number. You can enter the tax exemption number for a customer under the People > Customers menu.