Revindex Storefront supports almost every tax rule possible (e.g. collect percent tax rate based on country, state, postal code, quantity, product type, VAT, etc.). You can define individual tax classes from the Configuration > Taxes menu.

Click Add New then provide a name (e.g. "Goods") and choose a tax rule. Once the tax method has been added, you'll be able to assign any taxable products to the new tax method (e.g. Clothing products can be assigned to the "Goods" tax method, while shipping can be assigned to the "Services" tax method and taxed at a different rate).

Where it makes sense, you can enter up to 5 tax amounts in one tax calculation allowing you to break down and charge different tax rates by country, state, county, city and municipal level if needed for bookkeeping to comply with tax regulations. The sum of the individual tax amounts is what the customer will pay in taxes. If you don't care about tax levels, you can simply put your entire tax amount in the first level 1. If you intend to track and report the different levels of taxation, we suggest you follow the proposed ordering for consistency:

-

Tax amount 1 = Country

-

Tax amount 2 = State

-

Tax amount 3 = County

-

Tax amount 4 = City

-

Tax amount 5 = Municipal or any special jurisdiction

The custom tax formula can also use powerful XSL transform. The Storefront comes with several pre-defined tax calculation templates (e.g. flat rate tax, percent tax on the item amount and vary by country and state, etc.). In most cases, you can simply modify the numeric values without knowing XSL. If you have highly complex tax requirements, you can employ full XSL syntax to output the tax calculation. To learn more about XSL, please see the XSL Transform section.

Tax formula is calculated individually against each sales order detail that has a product assigned to this tax class. When your formula is being calculated, the current sales order detail is available in the "in/this/salesOrderDetail" node.

Tax providers

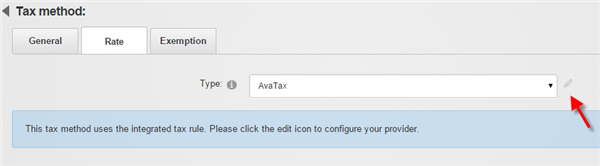

If you decide to use a tax provider (Avalara, Zip2Tax, etc.) to automatically calculate your taxes, you need to configure the credentials needed for the Storefront to communicate with the 3rd party provider. Click on the edit icon to enter your provider crendentials. Please see Providers for more information.